What does the Australian supermarket chain Coles have in common with the CIA? As of last week, both are clients of Palantir Technologies, a US tech company “focused on creating the world’s best user experience for working with data”.

In a three-year deal, Coles plans to deploy Palantir’s tools across more than 840 supermarkets to cut costs and “redefine how we think about our workforce”.

The tech company, named after magical seeing stones from the Lord of the Rings, offers comprehensive software that collects, organises and visualises a client’s data in “one platform to rule them all”. For an intelligence agency, Palantir’s tools might help identify a terror cell through phone calls and financial transactions; in a healthcare organisation, they might find ways to save money by shortening emergency department stays.

For Coles, the goal is to “optimise its workforce” by analysing “over 10 billion rows of data, comprising each store, team member, shift and allocation across all intervals in a day, every day”.

The announcement is linked to Coles’ plan to save a billion dollars over the next four years, and follows a 2019 big data deal with Microsoft, an effort to build robotic delivery centres, and the introduction of customer-tracking cameras and other high-tech security measures.

The Palantir process

What might this Palantir–Coles collaboration look like in practice?

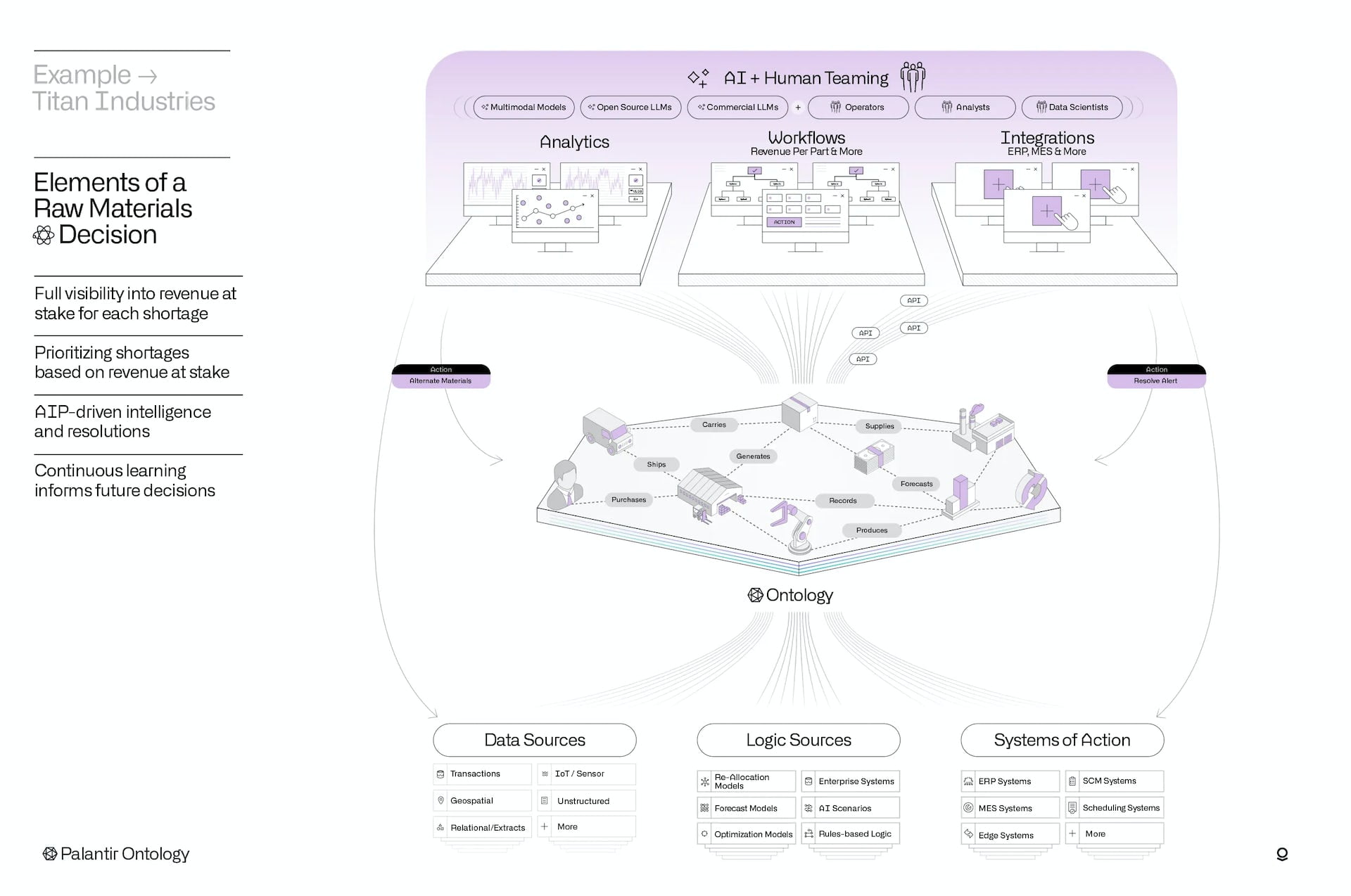

Typically, Palantir first sends out “forward-deployed engineers” to begin work with an organisation’s data, which is often messy, incomplete and fragmented. These engineers work with different branches and stakeholders to bring the data together into a single compatible whole called “The Ontology”, which contains all the information deemed relevant.

Then the data can be fed into Palantir’s platforms – in this case, customisable software called Foundry and the Artificial Intelligence Platform.

Read more:

How tech billionaires’ visions of human nature shape our world

The platforms let clients explore the data through dense but user-friendly interfaces populated by columns and rows, boxes and lines. The Artificial Intelligence Platform also brings ChatGPT-like language models into the mix.

Users might compare earnings between branches, flag a store that seems inefficient, or identify an upcoming period of high spending based on historic patterns.

All of this probably seems banal, or even boring. It’s certainly less overtly problematic than Palantir’s work with governments and law enforcement, which has been slammed for enabling data-driven deportation or racist policing, and seen the company described as “evil”.

Read more:

High-tech surveillance amplifies police bias and overreach

However, the deal doesn’t need to be overtly malevolent to be meaningful. A technology of surveillance and control is quietly becoming infrastructure, moving from front-page news to something ticking along silently in the background. In this sense, Palantir shifts from the visible to the operational, imperceptibly but powerfully shaping the lives and livelihoods of Australian supermarket employees and shoppers.

Optimising the workforce

We can briefly sketch out three implications of the deal.

First, by inking this deal, Coles frames itself as future-forward and logistically driven. Groceries and grocery-store labour become more data, just like the hedge funds, healthcare, or immigrants that other Palantir clients coordinate.

Read more:

Coles and Woolworths are moving to robot warehouses and on-demand labour as home deliveries soar

Supermarkets have been under fire over the past year for increasing profit margins through a pandemic and cost-of-living crisis, and accused of underpaying workers.

The Palantir deal continues this extractive trajectory. Rather than paying workers more or passing savings onto customers, Coles has chosen to invest millions in technology that will “address workforce-related spend” as part of a larger effort to cut costs by a billion dollars over the next four years. Food (and the labour needed to grow, pack and ship it) is transformed from a human need to an optimisation problem.

A walled garden

Second, dependence. As my own research found, Palantir clients tend to enjoy the all-encompassing data and new features but also become dependent on them. Data mounts up; new servers are needed; licensing fees are high but must be paid.

Much like Apple or Amazon, Palantir’s services excel at creating “vendor lock-in”, a perfect walled garden which clients find hard to leave. This pattern suggests that, over the next three years, Coles will increasingly depend on Silicon Valley technology to understand and manage its own business. A company that sells a quarter of Australia’s groceries may become operationally reliant on a US tech titan.

A way of seeing

Finally, vision. What Palantir sells is fundamentally a way of seeing. Its dashboards promise a God’s eye view that can stretch across an entire organisation or zoom in to granular detail to locate that “needle in the haystack” insight.

The claim is that this data-driven view is a shortcut to total knowledge, a way to map every operation, reveal every important element, and identify every inefficiency.

Palantir

Yet the data inevitably excludes significant social, financial and environmental information. The sweat of workers struggling to pack at pace, the belt-tightening of consumers struggling to make ends meet, and the struggle of farmers to survive unexpected climate impacts will go untracked.

Such details never appear on the platform – and if they’re not data, they don’t matter. Will Palantir’s data-driven myopia translate to how Coles views its workers and customers?

By placing Palantir at the heart of its operations, Coles quietly smuggles in several key assumptions: that food is a commodity to be optimised, that paying for labor is a risk rather than a responsibility, and that data can capture everything of importance. At a time of increased food insecurity, Australians should strongly question whether this is the direction one of our major grocery providers should take.

![]()

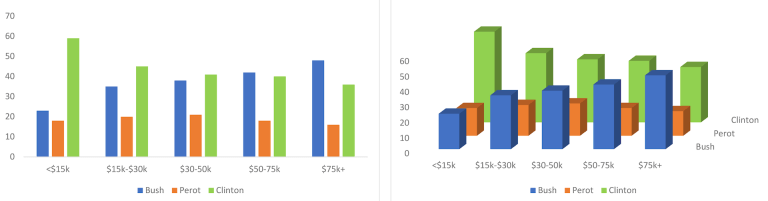

Luke Munn does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.