Today payment solutions online have reached a highly convenient stage, where the customer has endless options available. However, the downfall of several small to medium businesses is that they don’t pay attention to this aspect, losing out on customers. Not only can this deter new visitors from subscribing to your services or buying your products, but increase the abandoned cart rates.

If you’re keen to start a venture of any type, your business needs to be optimized to accept payments from customers through whatever means they prefer. Therein lies the challenge of finding the best payment platform for both the parties involved. Things can become tedious while weighing your options, to say the least. As a business owner, you need to sift through a lot of details, including the transaction costs, which can vary substantially based on parameters such as your average transaction volume and amount, or if you charge the clients online or in person.

In 2022, Square and Stripe are two of the best contenders for every business’s payment platform, making them industry favorites. Both of these brands have an extensive line of functionalities for small business owners, making it simpler to process payments. Be it accepting credit cards or wire transfers, there’s no minimum monthly income to qualify or a painstaking application to fill. Both of these platforms help merchants to bill their customers’ credit cards at an income as low as $2,000 at the start of their business. Speak of the ultimate convenience! But have you thought about which one is the best option for your business? Well, if you’re confused, we’ve done our homework so you don’t have to!

In this blog, we’ve compared in depth the two dominating payment platforms of 2022, Stripe and Square. Read along to gauge which of the brands is the best fit for you!

Stripe vs. Square at a Glance

To make things easier for you, we’re summarizing the takeaways from both Stripe and Square, where you get to compare the best features from both platforms. Since every business has its individual demands when it comes to payments, we’ve tried covering each of the functionalities in the section below as an overview. Let’s get right into what we loved most about each platform!

Stripe Overview

Stripe was started back in 2011 as a payment gateway to help businesses accept credit card payments by helping the transmission of money between a merchant account and the client’s payment account. This can be accomplished with a credit card or an online processing system.

Stripe functions on cloud-based frameworks meant to provide greater scalability, reliability, and security. It is also developer-friendly and complements business websites or web applications, being rooted in design as well as code. If you wish to use Stripe for WordPress, all you need to do is install the Stripe plugin which is open-source.

Additionally, Stripe can function as a standalone payment platform for businesses that have to send invoices and gather their payments on a time-bound basis. Even if this is not the most conventional use of Stripe as the majority of the businesses integrate to ecommerce platforms, this a different method to employ this flexible and optimized payment option.

The primary segregation between Square and Stripe is based upon their respective usage. While Square is considered the best choice for in-person payments and transactions, Stripe is more developer-friendly as a platform and suitable for e-commerce platforms, subscription models and other kinds of online payment systems. Mentioned below are the salient features of using Stripe.

Pros of using Stripe

- Best for in-person transactions

- Easy to use hardware for in-store and mobile payments

- Extensive POS and team management systems

- Free credit card reader

Cons of using Stripe

- Several complaints regarding the slow email response and other customer care problems.

- Chargebacks are not settled by Stripe- they will cost you if you lost the dispute.

- Has a very steep learning curve if you don’t have immediate technical expertise.

- Not meant for high-risk businesses.

Square Overview

Square as a payment processing system was founded in 2009 and technically does not fall under the premise of being a payment gateway. In reality, Square is an end-to-end payment processor, which is commonly called a virtual terminal. In contrast to Stripe, Square is used on compatible platforms, and is not a stand-alone payment gateway like Stripe. As a result, Square is an aspect of an ecommerce solution.

Using Square provides an extremely versatile experience due to the fact of it turning the customers’ devices into portable point-of-sales (POS) terminals, making Square’s core product their in-person point-of-sales system. It provides business owners a path to collect payments from clients by reading credit cards with a smart device or entering the credit card details manually.

In the years of its operation, Square has set the bar when it comes to competing with well-reputed names like Stripe. Today, you’ll find Square collecting in-store payments easily.

Pros of using Square

- Best for e-commerce, online payments, subscription platforms

- Developer-friendly

- Over 450 platforms and extensions

- International payment options with 150+ currencies

- Unified dashboard facilitating business operation management

Cons of using Square

- Several complaints regarding terminated accounts without prior intimation.

- Lack of functionalities, especially subscription-based tools.

- Not meant for high-risk ventures.

- Expensive for large businesses conducting a lot of business

Stripe vs. Square Set-up

Setting up Stripe for payments on your business platform can vary from being super easy to very complex, based on the expected functionalities of your payment gateway to do. This also is one of Stripes monetizing points.

The developer-friendly approach provides businesses the ability to make a custom checkout route for their customers. Stripe Elements helps your customers to add their data quickly and precisely, thanks to real-time validation, autofill features, dynamic localization, improved formatting, and masking functionalities.

On the other hand, Square focuses on simplifying its approach. All the software required to run your business payments are contained under a centralized algorithm. You will also be able to access Square’s advanced reporting tools, handle timecards, or deploy marketing campaigns right from the dashboard of a Square account.

When it comes to setting up a Square account, you have a few alternatives. For starters, one could cut and paste a code snippet to make a checkout option for clients on your business website. Or, a plugin like WooCommerce Square could be used to improve your ecommerce platform and add payment options. Or, one can download a plugin like WooCommerce Square to run your online commerce site and receive payments.

Square wins this round because users don’t have to worry about finding a host for their site.

Altogether, Square is a simple omnichannel solution for merchants wanting to sell anywhere without having to deal with complicated code or a bunch of third-party integrations.

Verdict: Square wins

WordPress Integrations for Stripe & Square

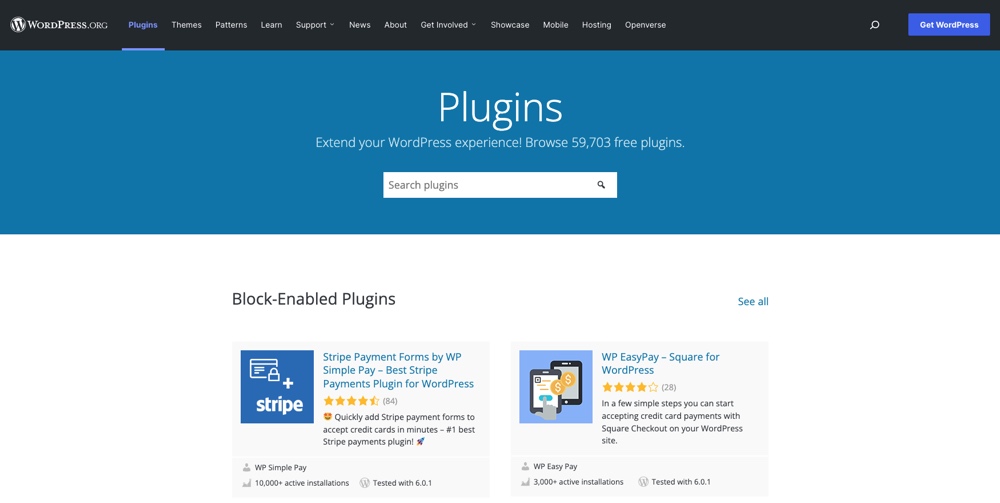

Stripe does not possess any official WordPress integrations or plugins. However, there exist several plugin developers who have made it easier to integrate Stripe into WordPress sites using a simple process.

Following are a few ways how you can integrate Stripe for WordPress with no added costs (other than your standard Stripe transaction fees):

- Set it up as a one-off payment gateway with WP Simple Pay for a basic WordPress site that does not have an online commerce feature

- Add a payment field to Gravity Forms (or with other form plugins) to receive donations, downloads and more

- Access it free along with a WooCommerce website (it’s one of the e-commerce plugin’s core payment options)

- Or use Easy Digital Downloads to have a similar setup with a different e-commerce platform

Square has a pretty smooth integration with your existing WordPress website. It can help to integrate via a free Square-supported online commerce plugins made for WordPress.

If a business owns a self-hosted WordPress (.org) site, you could integrate Square into the online store, just like Stripe. For example WooCommerce includes Square as a basic payment option, as does vcita. But due to the niche use of Square you might be required to pay an additional fee for a premium addon or upgraded version of the plugin, like for GiveWP or WPForms.

Verdict: Stripe wins

Payment Processor Features

Stripe does the job of making things easy so vendors that use it don’t have to deal with multiple merchant accounts. Mentioned below are the kinds of payments Stripe can accept once integrated with your online store:

- Credit cards

- Debit cards

- International cards

- ACG direct credit and debit

- Wire transfer

Stripe also can accept cryptocurrency like Bitcoin, which proves that this brand is open to exploring new avenues while investing in cutting edge technology.

Stripe supports more than 135 different currencies, which can help you reach an international customer base. The only disadvantage of using Stripe is the lack of in-person payments.

On the other hand, Square has extended its services to quench the demands of companies that wish to conduct business in-person as well as online. Here’s a the rundown of methods that Square accepts:

- Visa cards

- Mastercard

- Discover

- American Express

Additionally, it also accepts Apple and Android Pay, as well as eWallet payments. One feature that Square can give its customers is checkout hardware, a functionality lacking in Stripe. The cherry on the top is that the card reader and Point of Sales system is 100% free when used to accept mobile payments in person.

Verdict: Tie

Platform Costs and Fees

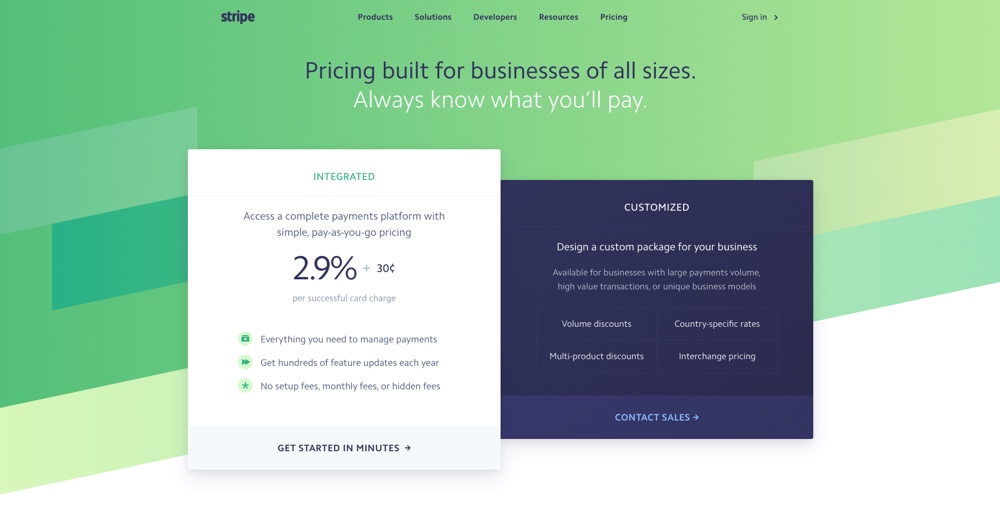

Stripe keeps things simple with its pay-as-go function. It excludes signup fees, being the affordable choice of the two.

Here’s a quick glance at Stripe’s fees:

- Basic transaction cost: 2.9% of the transaction + $0.30

- International Transactions: 3.9% per transaction (conversion fee subject to applicability)

- High-scale Transactions: Discounted to 0.8%/ transaction (capped at $5). The payment methods comprise ACH credit and direct debit, as well as wire transfers.

Stripe will bill a business $15 for every chargeback, unless it is in your favor. This Is a highly competitive rate as compared to other payment gateways, other than Square.

Square also doesn’t bill you for any signup fee or have any lock-in contracts. Additionally, they also rave about zero hidden charges, which is a relief considering today’s billing schemes.

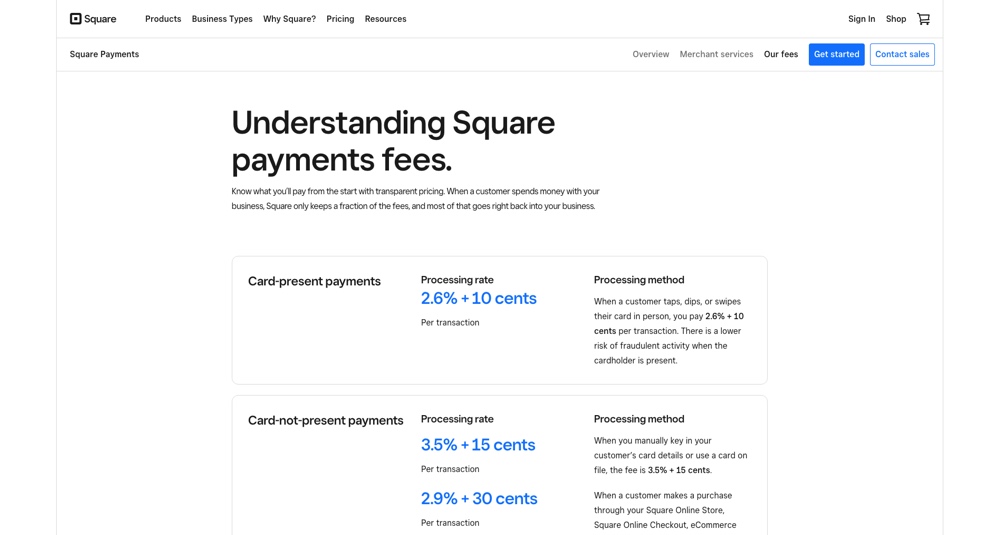

There are a few costs connected to Square since it provides both in-person and online transactions along with multiple functionalities. Here’s a rundown of the commercials:

The below mentioned payment kinds incur a transaction fee of 2.9% + $0.30:

- Square invoices.

- Online stores

- Online APIs

- Ecommerce cards on file payments.

The following payments types will attract a transaction fee of 3.5% + $0.15:

- Card-on-file transactions.

- Manually entered credit card details on physical machinery..

- Payments keyed in for POS APIs.

- Manually entered credit card details online.

Other than not billing a chargeback scheme. Square provides the customers a Chargeback Protection up to $250 per month upon qualifying transactions, which shows Squares regard for the customers.

Verdict: Stripe Wins

Customer Service & Support

Stripe does not have a spotless reputation pertaining to service and support. In the years before 2018, Stripe had zero means of reaching customer support in real-time.

To mitigate this issue, Stripe introduces access to a 24/7 live chat and phone support to help the pre-existing email support in 2018. If a business wishes to get in touch with other Stripe customers, they can look up the Freenode forum (#stripe) to address their concerns or interact. Today, not only does stripe have a multi-channel approach to customer support, but also an extensive knowledge base

Stripe also has a $1000/month premium support model, but we feel that the platform doesn’t need that modality since your 24/7 live chat and phone support can be accessed openly and without a heavy price tag.

Alternatively, Square currently has the below mentioned support choices for their customers:

- Phone and email support

- Live chats

- Dedicated Twitter account (@SqSupport)

Customers can also reach out to the Square Communities Forum by finding questions and keywords while networking with multiple users

Even though this may look great at first glance please note that the ratings of Square’s customer support is not always ranked the best in the league. Many clients complain about accounts getting frozen or blocked for zero reason. To worsen the effect, Square cuts off the phone contact to their customer care, stonewalling existing customers.

Verdict: Stripe Wins

Stripe vs Square, Which Platform Is Better?

Both the payment gateways are quite similar, but it is still a challenge to rank them both. To simplify our verdict, here are our statements:

- If a business requires the flexibility to conduct online and personal sales, Square wins hands-down with the omnichannel functionalities.

- If your business needs an online payments solution that can expand globally or adjust to a standalone invoicing collection solution, Stripe wins this round.

Final Verdict:

Picking the best payment gateway for your business is not an overnight fluke. With such closely matched points of Stripe vs Square, we think that the comparison comes to individual features that you may be looking for in your next payments processing system built on WordPress.

If you have a new business with an online store, but possess only limited technical know-how, Square would be the better choice out of the two. While it is priced competitively as compared to Stripe, it also comes with an easy set-up guide and a beginner-friendly knowledge base to help you.

However, if you’re on the lookout for a personalized checkout process, Stripe would be a better alternative due to its functionalities. If you have an ecommerce website that depends on the volume of sales, you will need each functionality to improve your business while generating greater sales. This can help you attain global reach, the option to add Stripe’s payment gateway to any platform like WordPress, or site of your choice, and get access to 24/7 client support.

To conclude, we would say that the choice depends on the type of business you run and your core requirements in terms of payment options that you’d like to add on a WordPress site! While both make excellent alternatives given their functionalities and reputation, the final decision lies in the hands of a business owner. We hope you enjoyed this detailed comparison; stay tuned for more such pieces on our blog section (like our other post on PayPal vs Stripe).